Paytm Share Price Surges 10%, Up 17% in July So Far

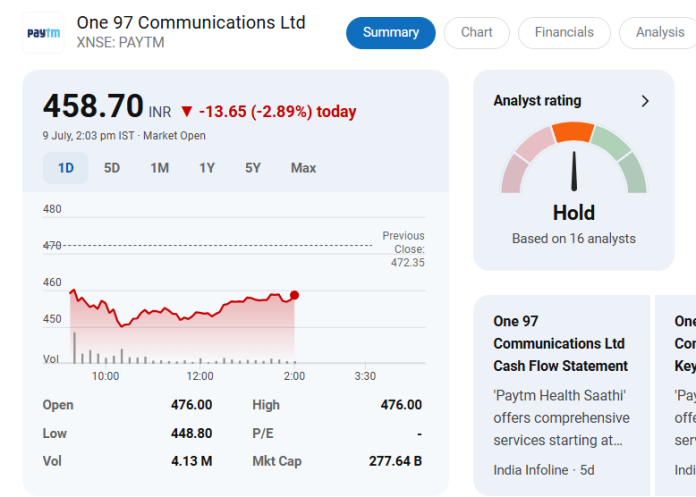

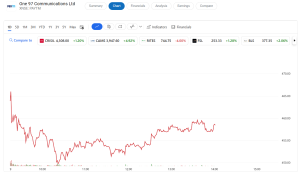

Paytm share price has seen a remarkable rise, surging 10% in intraday trade and up 17% in July so far. The current stock price of Paytm has been on an upward trend since June, following four months of declines. On July 8, Paytm’s parent company, One 97 Communications, saw its shares open at ₹437.55, jumping nearly 10% to ₹479.70, even as the Sensex was down 0.12%.

NSE Paytm: Strong Market Activity

The NSE Paytm stock witnessed heavy trading volume, with around 1.15 crore shares changing hands on the BSE, significantly higher than the two-week average of 26.44 lakh shares. The turnover reached ₹633.10 crore, with the stock closing 8.12% higher at ₹472.05 apiece.

Paytm Share Price Recovery

Paytm’s share price has rebounded significantly after a period of losses earlier this year. From February to May, the stock dropped about 53% due to the Reserve Bank of India’s directive to halt operations of Paytm Payments Bank for non-compliance with KYC norms. However, the current stock price of Paytm has recovered, reflecting renewed investor interest.

Reasons Behind the Surge

Experts attribute the surge in Paytm shares to value-buying and optimistic statements by the company’s founder and MD, Vijay Shekhar Sharma. He expressed confidence in Paytm’s growth, aiming to make it a $100 billion company despite recent challenges. This positive outlook has likely encouraged investors to buy shares.

Current Stock Price of Paytm: Technical Analysis

The current stock price of Paytm shows strong technical indicators. Analysts noted a bullish divergence on the weekly chart, suggesting a potential reversal from a downtrend to an uptrend. The stock has also formed a double-bottom pattern, indicating the end of a downtrend and the start of an upward move.

Read also: RVNL Shares Price Hit Fresh Record – Jumping 36%

Investment Opportunities in Paytm

Jigar S. Patel from Anand Rathi Share and Stock Brokers recommends buying Paytm stock in the range of ₹465–475 with a target price of ₹530. Mandar Bhojane from Choice Broking also sees potential, noting a breakout from an inverted head-and-shoulder pattern. If the price holds above ₹480, short-term targets of ₹530 and ₹565 are possible.

The current price of Paytm reflects a significant recovery and promising future prospects. With strong technical signals and positive investor sentiment, Paytm’s share is poised for potential gains, making it an attractive option for investors.